Recently, household energy storage giant Zhejiang Airo Network Energy Technology Co., Ltd. (hereinafter referred to as "Ailuo Energy") was officially listed on the Science and Technology Innovation Board of the Shanghai Stock Exchange, becoming the first A-share listed company in 2024. . In the context of tightening financing in the new energy sector and the termination of IPOs by many companies, the listing of Arrow Energy has once again attracted the attention of the industry to this company that focuses on the overseas household energy storage market.

However, as gas prices fall, demand for household energy storage in Europe has slowed down since the second half of 2023. The performance of my country's companies that focus on the overseas household energy storage market continues to be under pressure. The industry has expressed concerns about the prospects of European household energy storage business. After the "golden age" of European household energy storage, the trend of Chinese energy storage companies' overseas "campaign" has become increasingly obvious.

Borrowing the wind from European household savings

In the past few years, Europe has experienced an energy crisis, and the demand for home energy storage equipment has exploded. Airo Energy has seized this market opportunity. In 2022 and the first half of 2023, Airo Energy's European market revenue will account for more than 90%. Among them, the European market revenue in 2022 will be 4.358 billion yuan, an increase of 570 %. During the same period of opportunity, domestic inverter and energy storage battery companies such as BYD, Peneng Technology, Yuneng Technology, Ginlang Technology, and Sungrow Power also achieved rapid performance improvements, with both revenue and net profit attributable to the parent company growing at the same rate that year. Significant rise.

In May 2023, the IPO registration application of Arrow Energy Science and Technology Innovation Board was approved by the China Securities Regulatory Commission. The prospectus shows that during the reporting period (2020 to the first half of 2023), Airo Energy's operating income was 389 million yuan, 832 million yuan, 4.611 billion yuan and 3.339 billion yuan respectively, with an average annual compound growth rate of 137.97%. During the same period, net profits were 33 million yuan, 63 million yuan, 1.13 billion yuan, and 975 million yuan respectively.

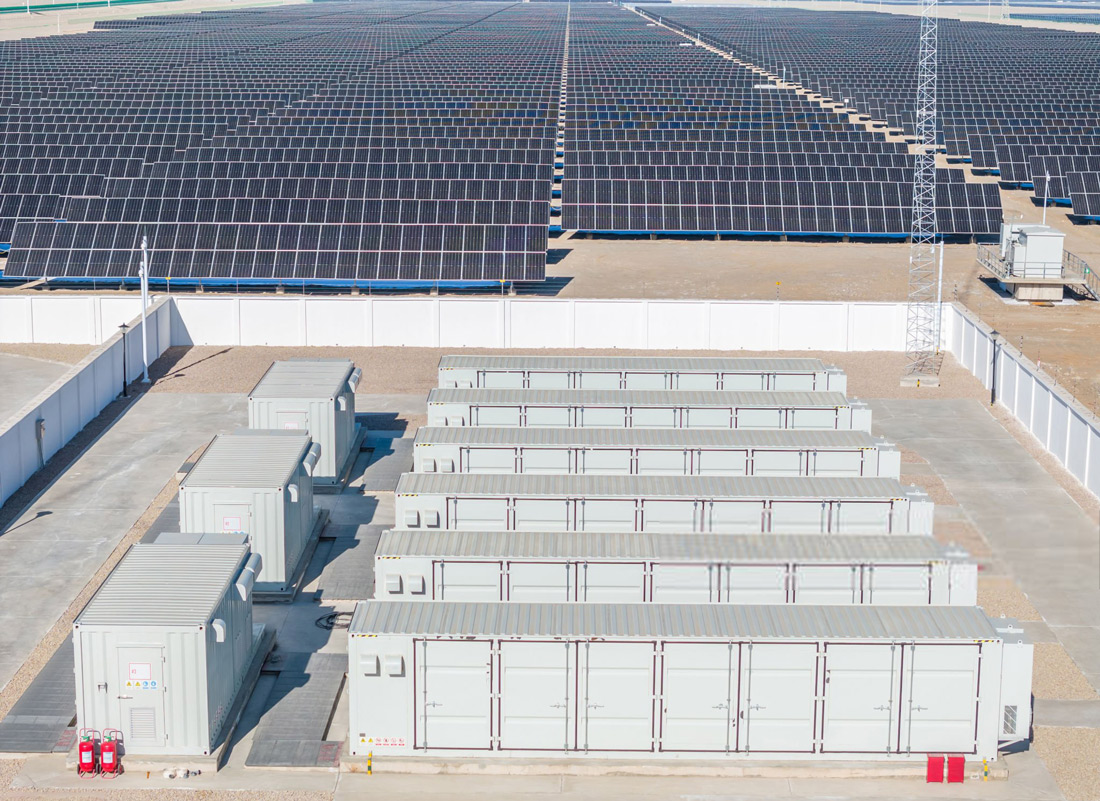

Regarding the 34-fold profit growth in three years, Arrow Energy stated that in recent years, the global energy structure has been transforming into clean energy sources such as photovoltaics. Industry support policies have been introduced one after another, and the price of electricity for European residents has increased. Household energy storage products Market demand is growing rapidly. The company entered the household energy storage business early and can provide users with complete energy storage systems. During the reporting period, the proportion of Airo Energy's household energy storage business revenue in its main business revenue continued to increase, accounting for 42.83%, 68.13%, 81.89% and 78.36% respectively.

Market growth slows down

Compared with the domestic market, European electricity is highly market-oriented. Coupled with the introduction of tax exemptions, purchase subsidies and other policy incentives in various countries, the energy storage business model has been fully operational and has good profitability. In recent years, the European market has become an important strategic direction for leading domestic energy storage industry chain companies.

Data shows that in 2022, the newly installed capacity of household storage in the European market will be approximately 5.7 GWh, a year-on-year increase of 147.6%, accounting for 36.4% of the global market. Among them, Germany, Italy, the United Kingdom, and Austria ranked among the top four markets in Europe with 1.54 GWh, 1.1 GWh, 0.29 GWh, and 0.22 GWh respectively.

As energy storage companies continue to expand production, European household energy storage product inventories have climbed to historic highs. Coupled with the factors of falling natural gas prices, residential electricity prices have fallen, and the market has continued to change for the better. The information disclosed by Arrow Energy also reflects market changes. In the third quarter of 2023, Airo Energy achieved operating income of 608 million yuan, a decrease of 57.37% from the second quarter, and a net profit of 42.8985 million yuan, a decrease of 90.91% from the second quarter, and its performance declined. The company stated that due to the lack of installation workers for household storage terminals in European countries, which has led to a backlog of channel merchant inventories, as well as the combined effects of multiple factors such as the fall in European electricity prices, the household storage market demand has decreased.

As energy storage companies explore overseas markets, the risk of performance changes has emerged. Arrow Energy admitted frankly that if the inventory of household energy storage channels in the future is not digested as expected, changes in energy supply and demand in Europe and other regions cause the price of electricity and other energy to drop significantly, or downstream market demand is saturated and other factors that adversely affect the industry, it may cause the market to have negative impact on the company. The demand for household energy storage products has decreased.

The first quarter may usher in an inflection point

So, has the era of rapid growth in household energy storage passed? In fact, this is not the case. Under the general trend of energy transformation, there is a "rigorous demand" for energy storage products in Europe, and emerging markets for household storage such as South Africa and Southeast Asia are also rising rapidly.

“The explosion of the European household energy storage market has stimulated domestic energy storage companies to quickly follow up and expand production on a large scale, causing the market to be oversupplied in the short term. After the inventory is exhausted, the household energy storage market will continue to move in a positive direction. Development." A person from a domestic energy storage company believes that the destocking of European household energy storage products is nearing completion. It is expected that the first quarter of this year will usher in an inflection point in demand, and orders and shipments from leading companies are gradually recovering.

Soochow Securities predicts that global household energy storage installed capacity will reach 17.3 GWh in 2024, a year-on-year increase of 26%, and a compound annual growth rate of 30% by 2025. Among them, household storage demand in Europe is expected to reach 10.1 GWh, a year-on-year increase of about 25%.

In order to seek new growth points, household savings companies have also embarked on a global "campaign", constantly exploring traditional markets outside Europe such as North America, Japan, and Australia, and also actively exploring emerging markets such as South Africa and Southeast Asia. Deye Shares mentioned in its semi-annual report that in the first half of 2023, there was a power shortage in South Africa and the demand for household energy storage increased sharply. The company's energy storage inverter revenue increased significantly, and it has established overseas subsidiaries in South Africa and Germany to strengthen in-depth promotion of the local market. ; Honeycomb Energy provides one-stop household storage solutions for African users; inverter companies such as Shangneng Electric and Growatt have invested in setting up factories in Southeast Asia.

"The demand for household energy storage in emerging markets is still in its infancy. The market entry threshold is low and companies can enter quickly. However, users are more price-sensitive and the gross profit margin of products is lower than that of European and American markets." The above-mentioned business person pointed out that energy storage Enterprises "going overseas" not only need to open up sales, but also constantly optimize products and maintain core competitiveness in a complex environment.